Buyer’s agent fees in Australia typically cost between 0.75% and 3% of the property purchase price + GST depending on several factors, including the services provided, the agreed pricing model, and the property location.

In this guide, we’ll break down the costs associated with each of these factors, and discuss how they may affect the cost of hiring a buyer’s agent to complete your next real estate purchase.

What You’ll Learn From This Guide:

- Services that buyer’s agents typically charge for

- Buyer’s agent fees: 3 Pricing models

- Buyer’s agent fees by location

- Are buyer’s agent fees tax deductible?

Services That Buyer’s Agents Charge For

The biggest factor affecting how much a buyer’s agent may charge you is the type of service you hire them for.

Ultimately, you have three options here:

1. Full Service

The most expensive buyer’s agent service offers a complete done-for-you approach, including everything from searching and short-listing suitable properties to managing the legal and financial paperwork via negotiations with buyers, attending auctions, and arranging necessary appraisals.

Most popular with first-time buyers and busy investors, the buyer’s agent fees for this full service typically range from 1.5% – 3% of the purchase price plus GST in major metropolitan areas.

That said, some buyer’s agents charge a flat fee for this service.

2. Appraisal and Negotiation

If you’ve already conducted your property search and found the perfect place, you can hire a buyer’s agent to carry out the appraisal and negotiation process.

Drawing on their in-depth knowledge of local market conditions, an agent can determine a fair and accurate value for your chosen property and offer professional advice on the best starting offer.

They can then pitch this offer to sellers on your behalf.

Some buyer’s agents charge a flat fee for appraisal and negotiation services, with prices ranging from $2,000 – $9,000+. Meanwhile, others may charge a percentage of anywhere from 0.75% – 1% of the property purchase price plus GST.

3. Bidding at Auction

Another probable scenario is that you find your dream home for sale, but rather than being up for negotiation, the owners plan to sell it to the highest bidder via auction.

In that case, you can enlist the support of an experienced buyer to represent you at that auction and bid on your behalf.

This is a good option for any busy property buyer who can’t make it to the auction in person. It also helps to ensure you stick to your budget, ensuring the peace of mind that comes with knowing you won’t end up overpaying.

Most agents charge a flat fee of between $500 and $800 to attend the auction and a success fee of around $1,000. Both fees are in addition to GST.

Using this pricing model typically makes auction bidding the least expensive of the three main buyer’s agent’s services. Speaking of which, let’s explore the different fee structures used by buyer’s agents.

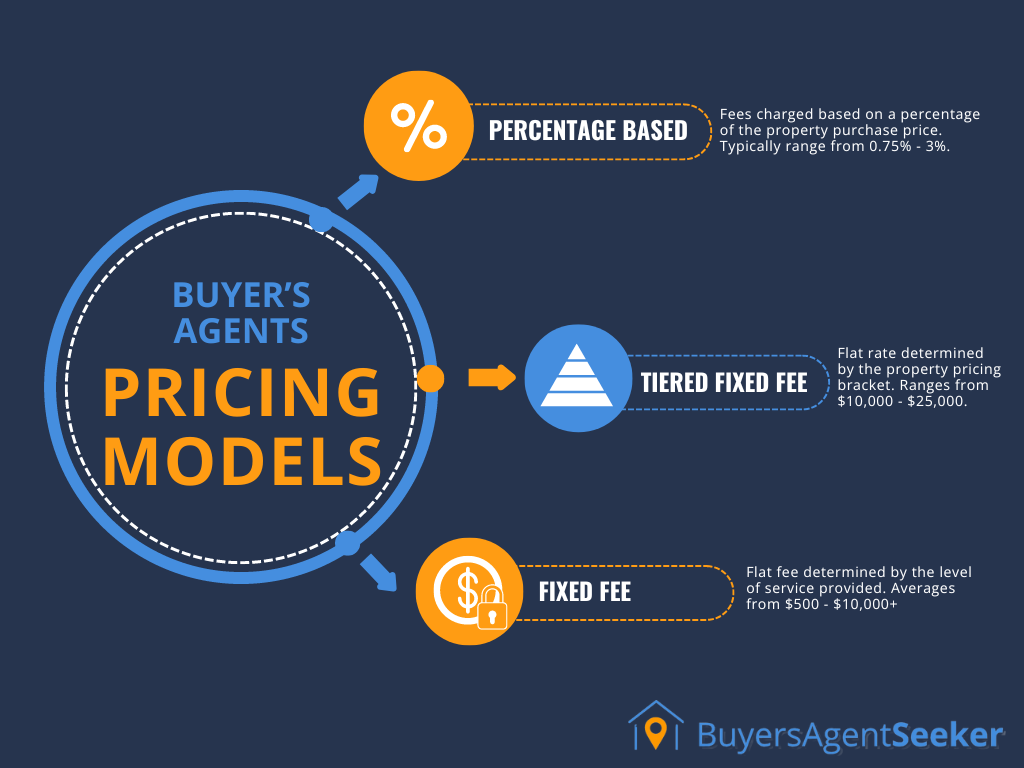

Buyer’s Agent Fees: 3 Pricing Models

So, you know what they charge for, but exactly how do buyer’s agents get paid?

That depends on the particular pricing model used by your agent. Let’s take a closer look:

Percentage of property price

The traditional buyer’s agent pricing model sees agents take a percentage of the final purchase price.

Depending on the location of the purchased property (more of which later) and the service provided, this can range from 0.75% – 3%, with a full service costing more than a negotiation or auction bidding service.

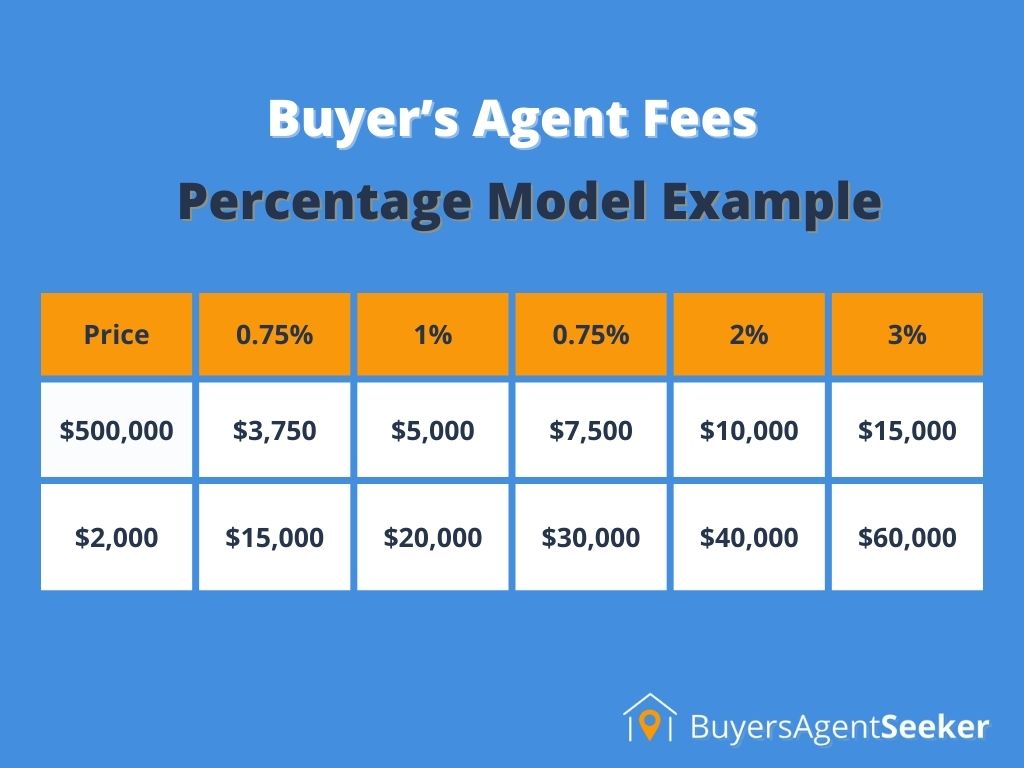

Of course, the type of property will also play a role. The following table outlines sample costs of hiring a buyer’s agent for both an affordable residential home and a high-end investment property based on the typical percentage range:

Tiered fixed fee

A buyer’s agent who operates on a tiered fixed fee structure will charge a flat rate determined by the price bracket your property falls into.

For example, if you have a budget in mind of around $1 million – $2 million, you can expect a higher fixed fee than one that falls below $500,000.

The following table details typical fixed fee rates for three different pricing brackets:

Fixed fee

Unlike the other two pricing models, a fixed fee rate isn’t determined by the cost of the property. Instead, buyer’s agents who operate on this model charge a simple flat rate based on the level of service provided.

In some cases, this might involve two or more payments, one when hiring them, and another payment, known as a “success fee” once the property has been purchased.

The table below provides a hypothetical example of how this works:

It’s also worth noting that a few agents work on a hybrid model, charging a flat fee for property purchases up to a specific purchase amount and a percentage-based commission on anything over that amount.

Upfront costs

Many Australian buyer’s agents will charge an upfront engagement fee that can cost anywhere from $1,000 to $5,000+.

Also known as a “retainer fee,” these payments are generally non-refundable but are deducted from the final invoice after the purchase has been completed.

Keep in mind that if your buyer’s agent is handling inspections and appraisals on your behalf, you may also have to pay the additional cost of hiring a property inspector in advance.

Buyer’s Agent Fees Calculator

Have a property in mind but not sure if it’s worth hiring an agent to assist you in the property buying process?

Use our free buyer’s agent calculator to determine the costs you’re likely to pay.

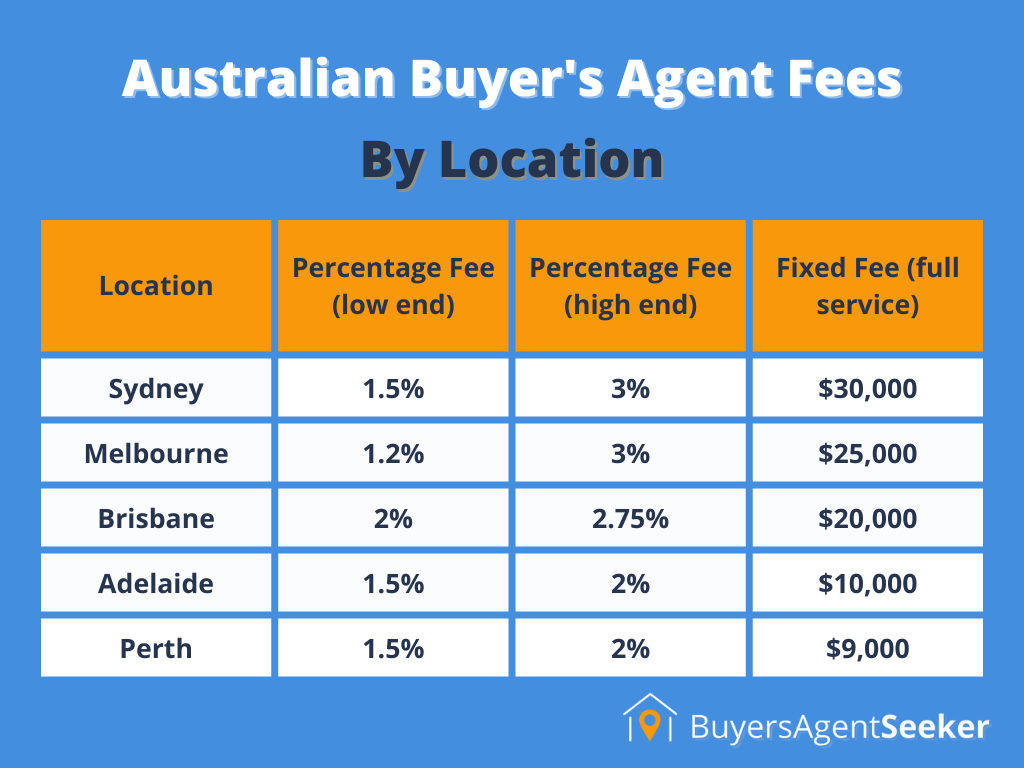

Australian Buyer’s Agent Fees by Location

Below, you’ll find a breakdown of the average buyer’s agent fees in Sydney, Melbourne, and other major Australian locations.

Buyer’s Agent Fees in Sydney

Sydney buyer’s agent fees typically cost around:

- 1.5% – 3% of the property price, plus GST (percentage model)

- $1,000 to attend an auction up to $30,000 for full-service support (flat fee model).

Buyer’s Advocate Fees in Melbourne

Typical buyer’s advocates in Melbourne charge the following fees:

- 1.2% – 3% of the purchase price plus GST (percentage model)

- $500 for auction attendance to $25,000 for full buyer’s agent services (flat fee model).

Buyer’s Agent Fees in Brisbane

Brisbane buyer’s agents tend to typically charge in the following price range:

- Around 2% – 2.75% of the purchase price plus GST (percentage model)

- $500 for auction attendance to between $15,000 – $20,000+ for full service (flat fee model).

Buyer’s Agent Costs in Adelaide

Fees for Adelaide buyer’s agents can range from:

- 1.5% to 2.5% of the property purchase price plus GST (percentage model)

- $500 for auction attendance to around $10,000+ for full-service support (flat fee model)

Buyer’s Agent Fees in Perth

Perth buyer’s agents tend to typically charge:

- Around 1.5% – 2.5%plus GST (percentage model)

- Around $500 for auction attendance, while fixed-fee full-service costs average about $9,000.

Are Buyer’s Agent Costs Tax Deductible?

Buyer’s agent fees are not tax deductible for owner occupiers.

As far as investment properties are concerned, guidance issued by the Australian Tax Office (ATO) states that you can not claim the cost of “Buyer’s agent fees paid to any entity or person you engage to find you a suitable rental property to purchase.”

However, buyer’s agent fees are deductible from capital gains tax calculations when it comes to selling your property.

In other words, while you can’t claim their fees on your annual tax returns, you can use them to reduce the amount of capital gains tax you need to pay once you sell up.

Is the Buyer’s Agent Fee Worth it?

Buyer’s agents’ fees are rarely cheap, but the benefits can certainly outweigh the cost for both residential and investment buyers alike. Not only do you save time and gain access to valuable expertise in the local property market, but you can also make considerable cost savings too.

What’s more, the Australian property market is becoming increasingly more competitive, with buyers typically outnumbering sellers by a large margin.

This is where a buyer’s agent can really prove their worth by using their insider knowledge of off-market properties to negotiate significant discounts on homes that haven’t been publicly advertised.

The annual PropTrack Off-Market Sales Performance report notes that:

- Nationally, off-market properties sell for 4.3% less than the initial asking price

- Buyers in New South Wales and Queensland have secured properties for 4% less than the initial property purchase price.

- In Sydney, buyers save as much as $60,000 purchasing off-market compared to a market-listed property.

If you’re serious about buying a property and want to maximise your chances of finding the perfect place at the perfect price, start your search for a trusted buyer’s agent today with Buyer’s Agent Seeker.